Check your Ratibi Card Balance online via the FAB website

Step 1: First, go to Bank FAB’s official website, or you can go there by clicking here.

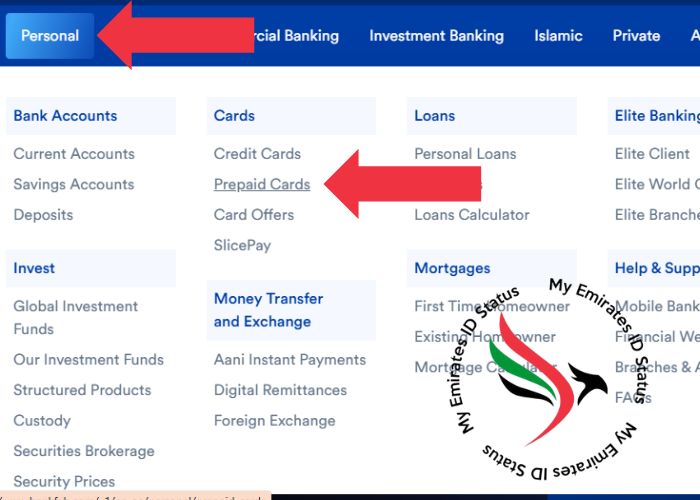

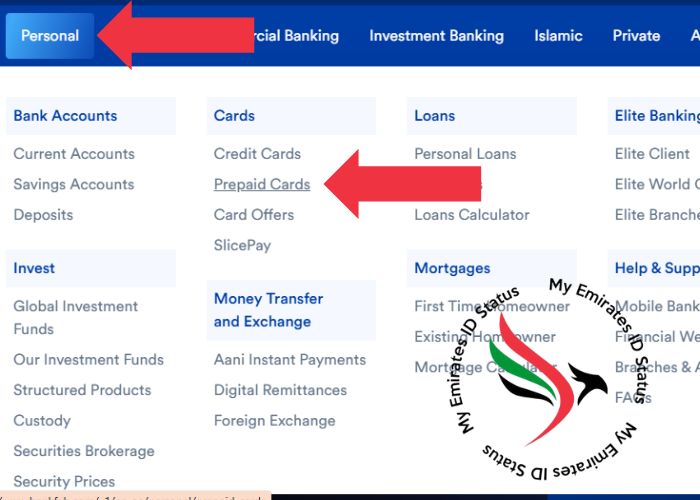

Step 2: Now, in the menu, hover over Personal. You will see the cards section; select Prepaid Cards.

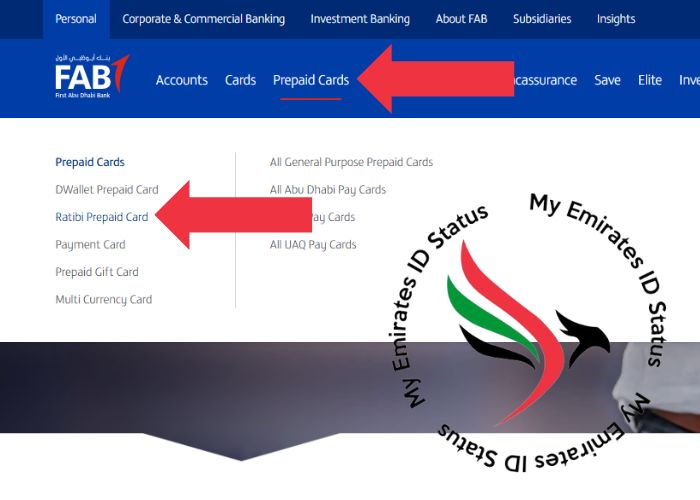

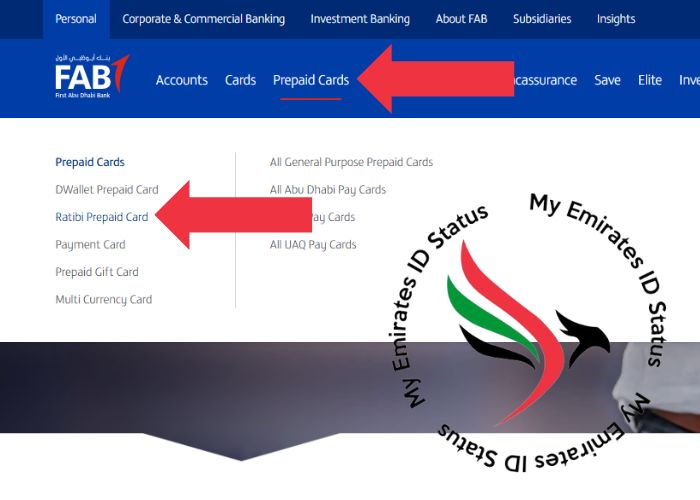

Step 3: In the menu, you see the Prepaid Cards. Click on it, and you will see the Ratibi Prepaid Card. Select it.

Step 4: Now, on the page, you will see Ratibi Prepaid Card Balance Enquiry. Click on it.

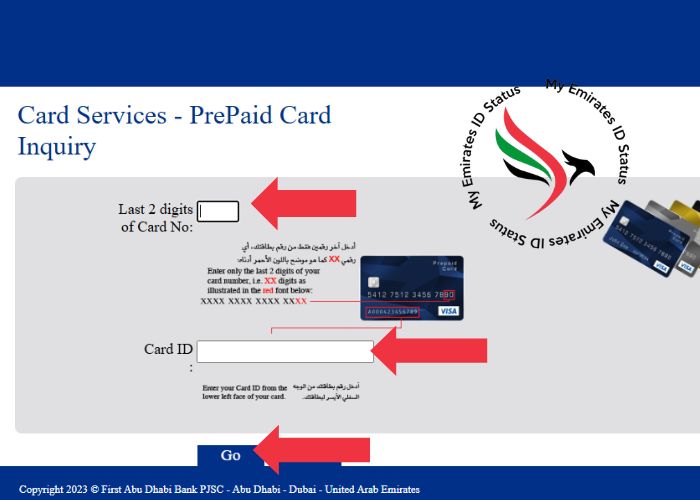

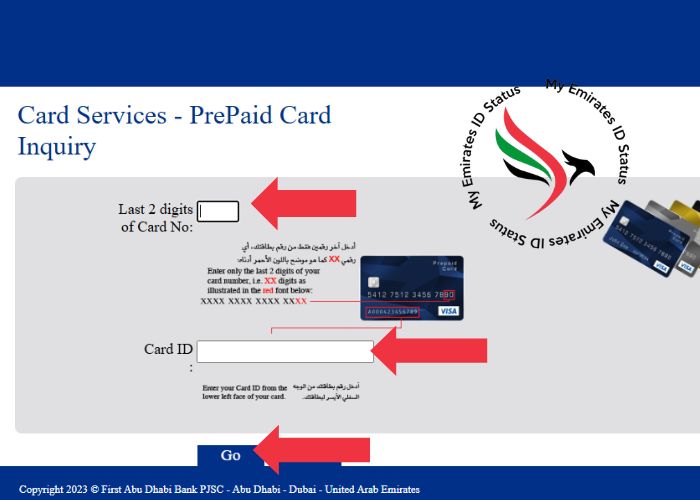

Step 5: Now you will be required to input the Last Two Digits of Your Ratibi Card Number and Full Card. You can find this on the front side of your Ratibi Card.

Step 6: Once you have entered your card details, click the “Go” button. The system will process your information and display your current balance on the screen.

Ratibi Card Salary Check by FAB Mobile application

If you do not want to go to the website, then you can check your salary through the FAB application. Below I describe the method you can follow it.

- Download the FAB application for IOS & Android.

- If you already have an account, you can log in to sign up by using your Ratibi card number, Emirates ID, or FAB Card.

- When you log in to the application, on the main screen, you can see the check balance or view balance button. Click on it.

- Now select your Ratibi card and view the balance.

Check your Ratibi Card Balance online via the Payit Mobile App

Most importantly, Ratibi Card holders can easily handle their financial transactions with Payit, a digital wallet application produced by FAB. Users can view their balance through three easy steps using the app as follows.

- Download the Payit app through the App Store platform or the Google Play Store.

- Register and link with your Ratibi card details.

- After logging in, you can see your account balance without delay.

Check your Ratibi Card Balance online via the FAB ATMs

You can go to the nearest FAB ATM to check your account balance through the ATMs.

- Place your Ratibi Card into an FAB Automatic Teller Machine (ATM).

- Enter your PIN.

- Select the “Balance Inquiry”

- The display screen will show your present account balance.

An internet connection is not required for using this solution.

Check your Ratibi Card Balance online via SMS Alerts (If Activated)

The notification system through SMS alerts provides Ratibi cardholders with salary credit information. Ratibi Cardholders who activate this service will automatically receive messages about salary deposits.

Note: If you have an NBAD Card, then you can check your salary at the NBAD salary check.

How to Apply for a Ratibi Card?

If you do not have a ratibi card, then you can follow the steps below and get one.

Step 1: Fill out the application form, which you can get by clicking here. In the form, you have to fill in the Employer’s name, company name, contact details, etc.

Step 2: Now, FAB gives you the Excel sheet template, where employees put the details about their employees

Step 3: Now you must fill out the iBanking application. By filling out this form, you can access the online tools for managing and monitoring the employee accounts.

Step 4: After filling the Ratibi Application form, Employee Excel sheet, and iBanking form, attach the necessary documents. Now submit the application to the nearest FAB branch or online portal.

Benefits of Insurance

- The 25,000 AED free personal accident insurance.

- For the repatriation of mortal remains, the 5000 AED maximum insurance.

- Due to the accident, you were admitted to the hospital, and then you will get 1500 AED for the 30 days.

Benefits of Using Ratibi Card for Salary Payments

Workers who use the Ratibi Card benefit from various advantages with their employers through the system.

- No Bank Account Needed: Ideal for employees without a traditional bank account.

- Free SMS: When your salary is credited, you will receive an SMS.

- Convenient Access: Easily check your balance online, via ATM, or mobile app.

- Worldwide Acceptance: This prepaid card works internationally due to acceptance at every Mastercard facility worldwide.

- 24/7 Availability: The Ratibi Card enables users to access their salary automatically at all times, apart from going to the bank.

Tips for Managing Your Ratibi Card Effectively

Getting the best from your Ratibi Card requires these essential pieces of advice:

- Regularly Check Your Balance: The habit of monthly balance review should become a regular practice for you.

- Keep Your Card Details Secure: Protect your card information by refusing to disclose your PIN and card ID to others.

- Activate SMS Alerts: SMS alerts enable you to receive real-time updates about your salary deposits and transaction activities.

- Monitor Transactions: Regular checks should be performed to detect suspicious financial activities.

- Use the Payit App: Access your balance through the Payit App to achieve a straightforward and instant balance overview.

Online checking of your Ratibi Card salary follows straightforward steps that grant you continuous financial management control. Quick, secure convenience is available through any of these methods, including the FAB Prepaid Card Inquiry portal, FAB application, Payit mobile app, and ATM functions.

Regularly or weekly check your balance through everyday routines and contact FAB support staff in case of any bank-related problems. Online checking of your Ratibi Card account remains a convenient way to maintain financial security while properly managing your money.

FAQs

1. Is there any fee for checking my Ratibi Card balance online?

No, online balance checking through Ratibi Card requires no fees from users.

2. Can I withdraw cash from ATMS using my Ratibi Card?

Yes, you can obtain cash withdrawals from FAB ATMS and from any Mastercard network-enabled ATM.

3. What should I do if I lose my Ratibi Card?

One should immediately contact FAB’s customer support to block the card while requesting a replacement.

4. How often can I check my balance online?

There’s no limit. Your account balance is available for checking through online services without any restriction on frequency.

5. Can I use my Ratibi Card for online shopping?

Online shopping is possible with your card as long as you possess approval to execute digital transactions.